On Friday, January 31st, a new Belgian federal coalition was formed, known as the Arizona Coalition. This coalition has reached a consensus on a common vision and priorities up to 2029.

While the exact content and timing of this agreement are still to be defined, several key points related to mobility have already been announced, which could significantly impact both businesses and employees.

This blog provides an overview of the most important changes.

Other important changes

Conclusion

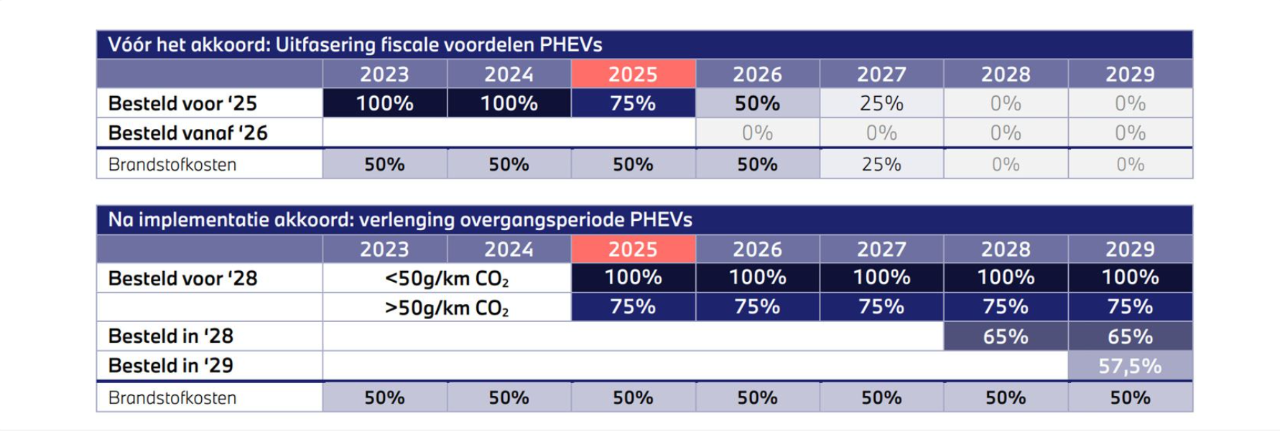

The Federal Coalition Agreement 2025 brings a number of important changes that will affect both businesses and employees. From reducing the tax deductibility of PHEVs to the mandatory introduction of the mobility budget for all employees. These measures are aimed at promoting sustainability and mobility.

The insights in this blog are subject to changes in the timing and content of the coalition agreement.