You have undoubtedly heard of “leasing”. Leasing is particularly popular in a business context, especially for financing company cars.

But what exactly is leasing? What does it involve? What types of leasing are there? And what are the advantages that make leasing so popular?

Find out in this blog.

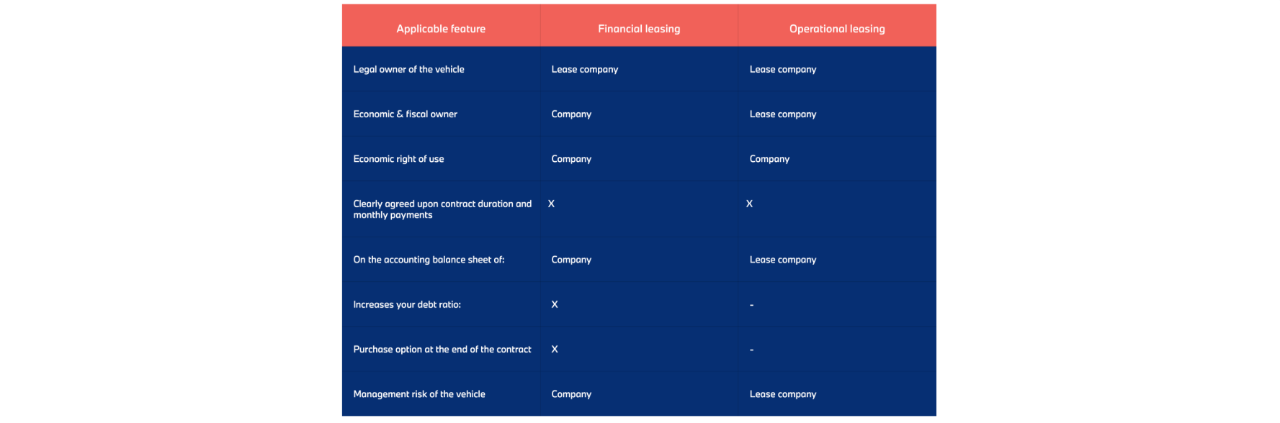

What types of leasing are there?

Discover your options at Alphabet

Want to know more about operational leasing? Click on the button below and discover our options.