Selecting the right business car financing product can feel intimidating.

This decision, crucial as it is, can significantly impact the operational efficiency and financial health of your business.

In this article, we'll guide you through the most common options, helping you to understand what each involves, and how they could fit your business's unique needs.

Getting familiar with fleet financing

The first fleet funding decision usually comes down to whether to purchase vehicles outright or to use a finance option. Both come with advantages and disadvantages.

Purchasing vehicles outright can give total control over your fleet (since you’re not subject to contractual agreements around elements like mileage, servicing, or vehicle sale), but it also means substantial up-front costs and usually needs more resources to manage (since you’re responsible for everything yourself).

Financing vehicles through a leasing provider, on the other hand, offers lower initial costs, predictable monthly payments and reduced administrative effort via options that include servicing, maintenance and repair, but also means you’ll be subject to contractual agreements (and potential penalties for breaching these).

Still not sure which is right for your company?

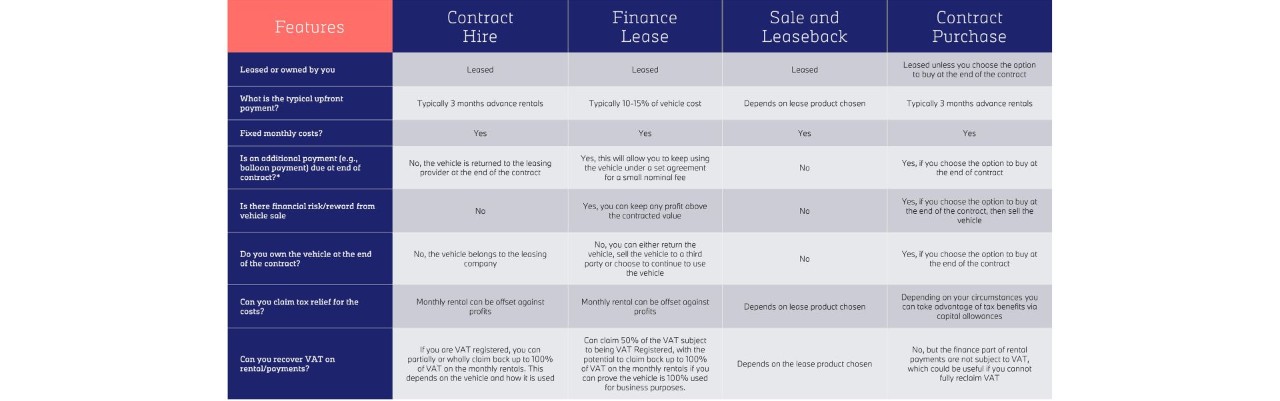

As a seasoned player in the fleet leasing financing industry, Alphabet offers a comprehensive suite of financing solutions tailored to diverse business needs. Whether your business is looking for a Finance Lease, Business Contract Hire, Contract Purchase, or a Sale and Leaseback solution, Alphabet can provide the guidance and support you need to make the best decision.

Our team of experts understand the complexities and nuances of fleet financing. They work closely with your business to understand your unique requirements, financial situation, and long-term goals. This customer-centric approach enables us to recommend the most suitable financing product that aligns with our customers’ strategy and objectives.

Get in touch

Got questions? We’ve got answers

-

Mon - Fri 08:30 – 17:30