Introduction

The 2025 Autumn Budget outlined the Government’s fiscal response to a period of economic turbulence, with a heavy focus on the cost of living, NHS waiting lists, and the national debt.

Sweeping changes are also afoot for motorists and fleet operators over the next few years, with plans to introduce an Electric Vehicle Excise Duty for electric and plug-in hybrid cars from 2028, coupled with the removal of the temporary fuel duty relief in 2027.

For drivers of plug-in hybrid cars, a temporary Benefit in Kind easement will apply to models subject to more stringent CO2 testing procedures.

The Government has further pledged £1.3bn in additional funding for the Electric Car Grant, while increasing the threshold of the Vehicle Excise Duty Expensive Car Supplement by 25% for zero-emission vehicles in 2026.

We have summarised the changes relating to the vehicle leasing industry and how these could impact you.

From 1 April 2026

Cars manufactured before 1986 will be exempt from paying VED under the rolling exemption for vehicles constructed more than 40 years ago

Not over 1549cc

• 2025/26: £220

• 2026/27: £230

Over 1549cc

• 2025/26: £360

• 2026/27: £375

Light goods vehicle (including zero emissions)

• 2025/26: £345

• 2026/27: £360

Applies to vehicles registered on or after 1 March 2001 and not exceeding 3,500kg

Euro 4 light goods vehicle

• 2025/26: £140

• 2026/27: £140

Registered between 1 March 2003 and 31 December 2006 (not exceeding 3,500kg)

Euro 5 light goods vehicle

• 2025/26: £140

• 2026/27: £140

Registered between 1 January 2009 and 31 December 2010 (not exceeding 3,500kg)

Electric Vehicle Excise Duty

The Chancellor has set our plans for a new Electric Vehicle Excise Duty (eVED), or mileage tax, for electric and plug-in hybrid cars.

From April 2028, battery electric car drivers will pay a road charge of 3 pence per mile, while plug-in hybrid drivers will pay 1.5 pence per mile, with the rates going up each year in line with inflation. It does not apply to light commercial vehicles, HGVs, and motorcycles, which will initially be exempt from the eVED.

Therefore, the owner of an average electric car driving 8,000 miles per annum can expect to pay an additional £240 per year in 2028/29.

Electric Car Grant

The Electric Car Grant (ECG) has been extended until 31 March 2030, and will receive an additional £1.3 billion in Government funding to help more drivers make the switch to electric.

The level of the grant available on the purchase of a qualifying battery electric car is subject to the price of the vehicle not exceeding £37,000, coupled with the manufacturer’s commitment to a verified Science Based Target, based on the location of vehicle assembly and battery cell production.

The ‘greenest’ vehicles in band one will receive up to £3,750, with band two vehicles receiving up to £1,500.

Level of grant available

- Band 1 - Cars with lowest carbon emission scores: £3,750

- Band 2 - Cars with higher carbon emission scores: £1,500

Cars made by manufacturers that do not have a set science-based target are not eligible under the ECG.

Four cars currently qualify for the maximum grant of £3,750; these are the new Nissan Leaf, Citroën ë-C5 Aircross Long Range, Ford E-Tourneo Courier and Ford Puma Gen-E.

For a list of cars that qualify for the Band 2 grant of £1,500, visit Gov.UK

EV Charging Infrastructure

The Chancellor has announced an array of fiscal measures to support the electric vehicle (EV) chargepoint rollout, which include:

- £100 million for local authorities and public bodies to support the training and deployment of specialist staff to accelerate the rollout of public chargepoints

- £100 million, in addition to £400 million of funding announced at 2025 Spending Review in June, to invest in EV charging infrastructure, including the installation of home and workplace chargepoints

- A consultation on permitted development rights for EV charging to accelerate the rollout of cross pavement charging solutions, to make EV charging easier, cheaper and more accessible for households without driveways

- A 10-year 100% business rates relief programme for eligible EV chargepoints and EV-only forecourts

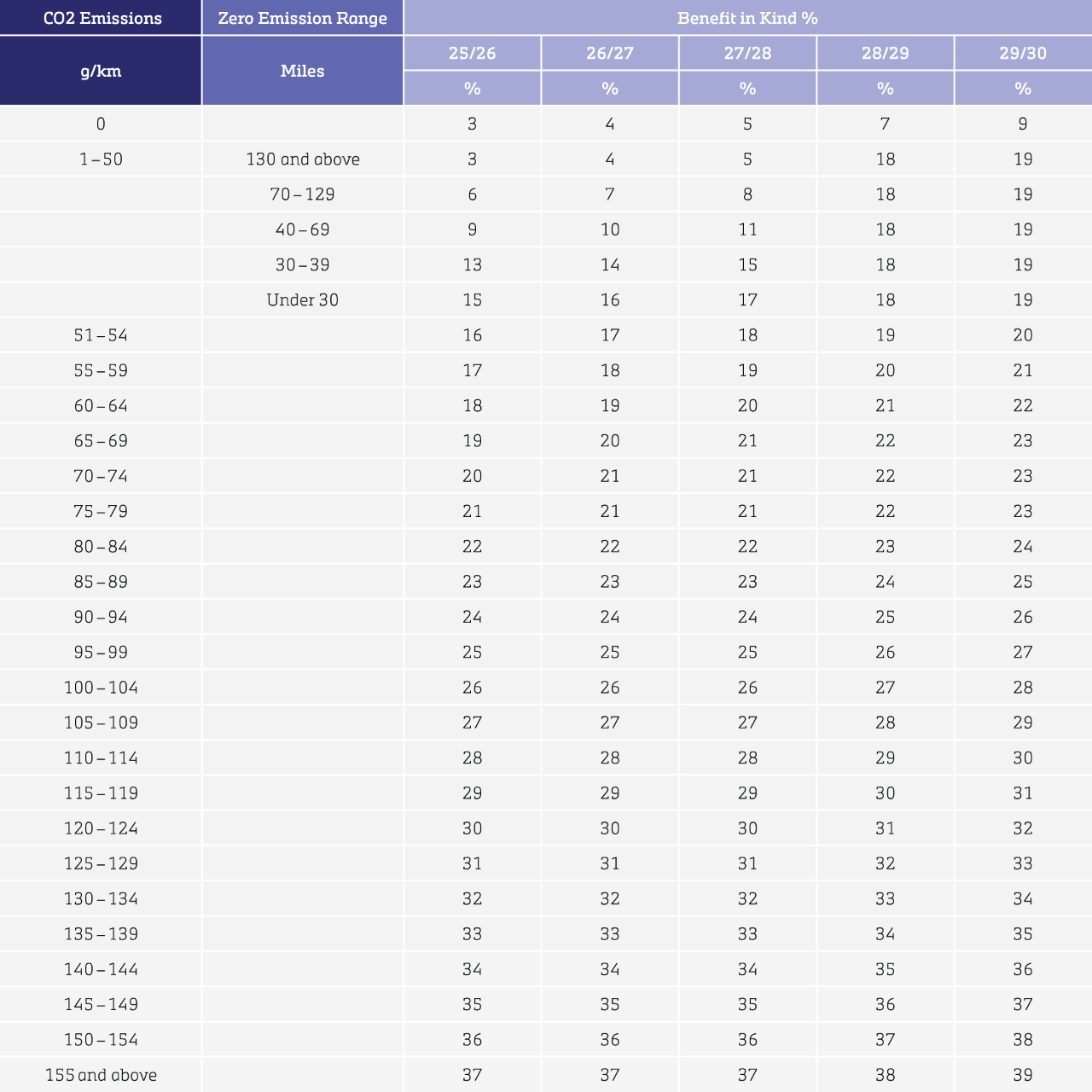

Company Car Tax

Due to the re-homologation of plug-in hybrid electric vehicles (PHEVs) under the Euro 6e-bis standards, the CO2 emissions of many PHEVs will increase. It will result in a significant increase in Benefit in Kind (BIK) tax for up to 150,000 company car drivers.

To mitigate the impact of these changes, a temporary BIK tax easement will apply, retrospectively from 1 January 2025 in Northern Ireland and from 6 April 2026 in the rest of the UK where:

- a car was first registered on or after 1 January 2025

- a car’s CO2 emissions figure is 51 or more

- a car was not registered under the Euro 6d-ISC-FCM or Euro 6e standards

- a car’s electric range figure is 1 or more

For a PHEV company car made available on or before 5 April 2028, the easement will apply subject to transitional arrangements until 5 April 2031.

This change will also reduce the Class 1A NIC payable by employers.

Fuel Duty

Fuel duty will remain at the current rate of 52.95 pence per litre until September 2026, extending the temporary 5 pence per litre cut for a further five months.

The temporary cut introduced in 2022 will be reversed gradually, as outlined below, with fuel duty then being uprated in line with inflation from April 2027.

Timetable for reversal of temporary cut in fuel duty:

- 1p increase from 1 September 2026

- 2p increase from 1 December 2026

- 2p increase from 1 March 2027 (returning duty to the pre-March 2022 level).

Capital Allowances

Capital allowances provide tax relief on the costs of capital assets, such as cars and vans, in place of commercial depreciation on which tax relief is not available. Capital allowances are claimed either over several years via writing down allowances (WDAs), or all at once via a first-year allowance (FYAs) with excess relief being repaid over many years after the sale of the vehicle by the business.

The main rate of WDAs has been 18% per year since 2012. However, from April 2026, the rate will be reduced to 14% per year.

The 100% FYAs for zero-emission cars and electric vehicle charge-points will be extended by one-year to April 2027, but no announcement was made regarding zero-emission vans.

From 1 January 2026, a new FYA of 40% will be introduced for vans, including those bought for leasing.

Employee Car Ownership Schemes

As announced during the 2024 Autumn Budget, the Government plans to amend the Benefit in Kind rules, so that vehicles provided through Employee Car Ownership Schemes (ECOS) will be deemed to be taxable benefits, subject to company car tax.

Draft legislation published in July 2025 indicated these changes would come into effect on 6 October 2026. However, to give employers more time to prepare for, and adapt to the change, it will now be delayed to 6 April 2030, with transitional arrangements applying until April 2031.

As the eligible vehicle numbers are expected to grow over time, the discount level will reduce from 4 March 2030 to 12.5% for electric cars and 25% for electric vans, HGVs and quadricycles, provided they are registered on Auto Pay.

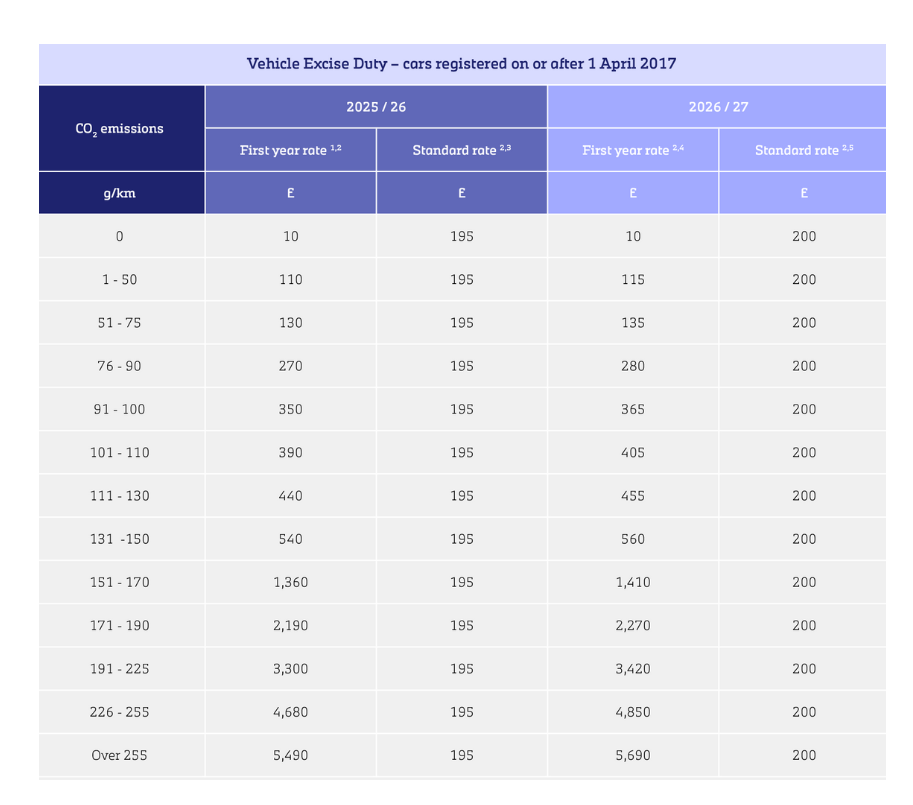

1. A car propelled solely by diesel which does not meet the Real Driving Equivalent (RDE) Step 2 standard will be subject to a first-year rate equivalent to the band above its actual emissions, up to the maximum of £5,490.

2. There is no alternative fuel discount available for any car from April 2025, regardless of when it was first registered.

3. All cars, excluding those with zero emissions registered before 1 April 2025, with a list price greater than £40,000 when new will be subject to an annual £425 expensive car supplement on top of the standard rate for 5 years.

4. A car propelled solely by diesel which does not meet the Real Driving Equivalent (RDE) Step 2 standard will be subject to a first-year rate equivalent to the band above its actual emissions, up to the maximum of £5,690.

5. All cars with emissions greater than 0 g/km and a list price greater than £40,000 when new will be subject to an annual £440 expensive car supplement on top of the standard rate for 5 years. All zero-emission cars registered from 1 April 2025 with a list price greater than £50,000 when new will be subject to the annual £440 expensive car supplement, but zero-emission cars registered before 1 April 2025 are exempt.